What is the issue?

As we approach retirement, research suggests that most underestimate the amount of wealth needed to afford the lifestyle that they want once they stop working. Changes to pension structures, lower interest rates, higher inflation and longer life expectancy have all combined to mean that the amount of money needed may be higher than originally predicted.

Why does it matter?

There are many factors that affect the size of the pot needed. People have different outgoings, aspirations, and expectations. For those looking forward to life after work it is important to make sure they can afford the lifestyle they hope for. The amount of money needed might seem daunting but being aware of the potential problem and planning accordingly can help keep plans on track. Often, the earlier you start saving for retirement, the more you will likely have when the time comes.

What should I do about it?

The first step towards planning for retirement ought to be taking stock of the current wealth designated for retirement, and the anticipated level of capital you are likely able to save between now and retirement. With this information, you need to understand the investment returns required to make your financial aspirations achievable.

Working with a financial planner can make this process less painful and more efficient. Your Waverton Wealth financial planner will use their experience to build you a financial plan based on all your personal information and financial aspirations. This bespoke financial plan will focus on what is most important to you and help you structure your finances in a manner that is tax efficient throughout the different stages of your life.

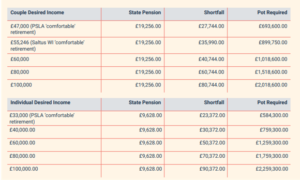

The table below, from the Annual 2022 Saltus Wealth Index, gives an indication of the size of financial pot likely to be required for different levels of retirement income in the UK. If you would like to get in touch with one of Waverton’s wealth planners, for help with your financial planning and investments, please get in touch here.

Recently, the PSLA has increased the standards required to achieve a ‘comfortable’ lifestyle to factor in the higher inflation experienced in the past year. You can see the revised Retirement Living Standards at https://www.retirementlivingstandards.org.uk/