Early retirement does not need to be pie in the sky and can be a legitimate option for some people. Retiring early is a goal for many so that you can enjoy life whilst still young and healthy. It does require some early investment, however, and isn’t always for everyone but here are the basics to remember:

There are currently no age restrictions in the UK as far as retirement is concerned. Ensuring you have the funds to do so, however, does depend on your circumstances – as a general rule of thumb, you’ll need 20x your unfunded retirement expenses in savings/pensions. For example, if your retirement expenses are £30,000 per year, you will need £600,000 in savings/pensions.

For the average person, retiring early may simply be a theory, but even just working five years longer could make a huge difference to your projected retirement income and how long your investments last thanks to extra contributions and compounded investment growth. A professional advisor will be able to sketch a better picture for you based upon your individual circumstances and financial health.

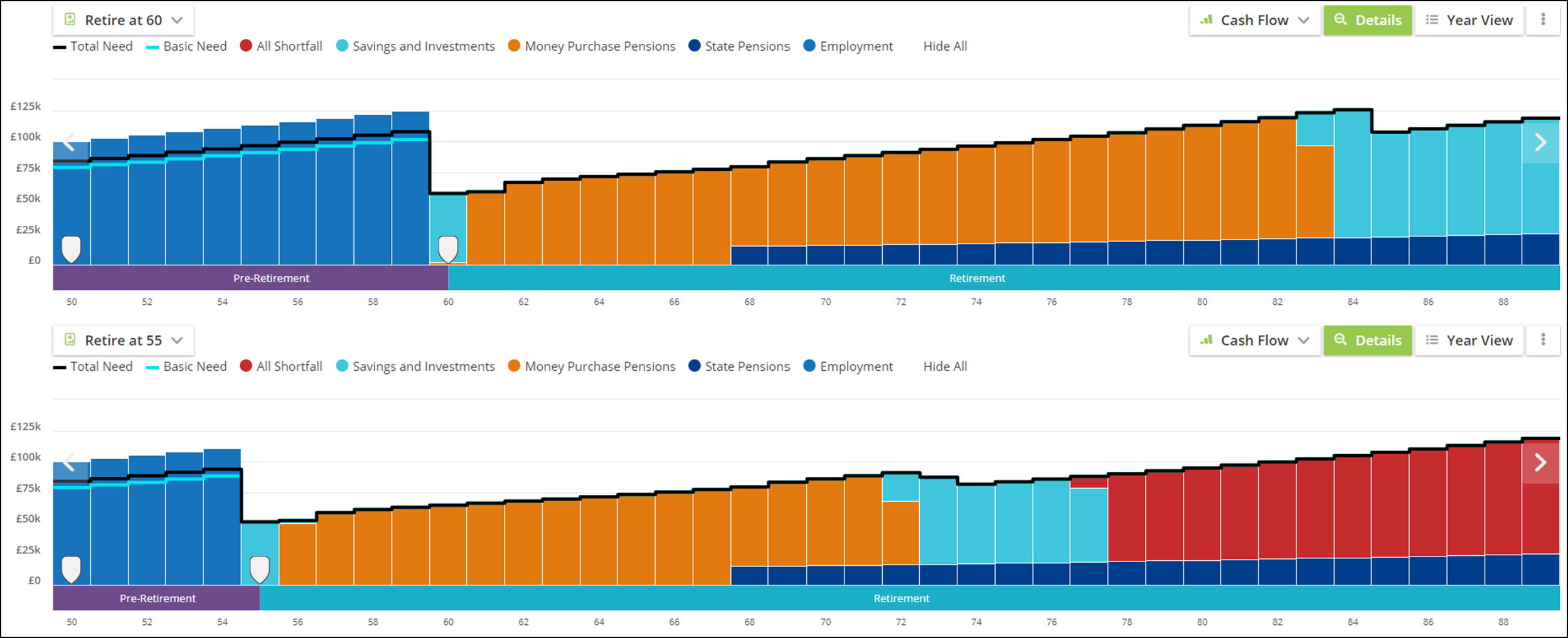

At Waverton Wealth, we use sophisticated cashflow modelling software to help clients map out their financial future.

In this fictional example, we have Mr Client, aged 50, who:

- Earns £100,000 per year, contributing 5% of his salary into his pension, his employer also contributing 5%

- His pension is currently valued at £500,000

- He has an ISA worth £100,000

- He predicts he will need £50,000 per year for expenses in his retirement

In this situation, we have looked at two different retirement dates: one at age 55, and one at 60.